Our retirement calculator can help you figure out how much you should be saving for retirement each month. Now the IRS does the math based on a salary of 90000 and you end up owing 18293almost 3000 less.

I Make 90 000 A Year How Much House Can I Afford Bundle

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow.

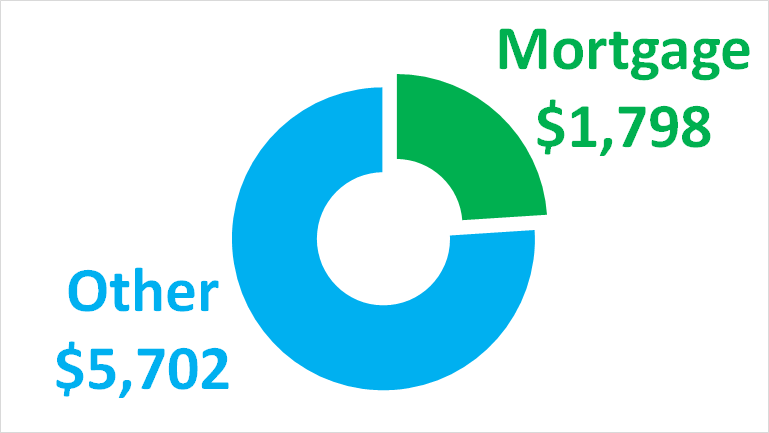

Mortgage 90k salary. Its really all in what youre comfortable with what your other expenses are. Using a 300000 mortgage heres an example. Those are with property taxes and insurance included.

I pay my rent and bills and run a car and have a whole life on this and less. Interest youve paid on a mortgage. Make 90k a year.

Also your total monthly debt obligations debt-to-income ratio should be 43 or lower. The SmartAsset budget calculator on the other hand tells you how the average person like you in your neighborhood is saving. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only.

Im preapproved to 400k mortgage. This adds up to a total of 16580400 which means the interest over those 25 years is 7580400. 400k - 2400month 350k - 2100month.

If you make 50000 a year your total yearly housing costs should ideally be no more than 14000 or 1167 a month. There are deductions for all kinds of things. Its down to lifestyle but 900 is a lot still if you count every penny and make every penny count.

But theyve received an interest rate of 325 and their potential mortgage amount is roughly 721000. How do mortgage lenders decide how much you can borrow. As above normally if you made 100000 youd owe the IRS 21036 in taxes.

Combined we pull in under 90K our mortgage is around 1050month though we had been approved for nearly double that amount. 10250 month 300000 x 041. Salary Range 52k - 90k 69k 68833.

But say you have 10000 in deductions. So if youre buying a house worth 200000 paying a 20000 deposit and borrowing the remaining 180000 your loan to value will be 90. First California Mortgage Company.

Typically the higher your loan to value the higher the interest rate. The national average salary for a Mortgage Underwriter is 76624 per year in United States. One answer suggested that a borrower earning 90000 annually will qualify to buy a 360000 home.

To find a mortgage to suit you speak to one of the expert brokers we work with. Thus in doing our. What is a 90k after tax.

Filter by location to see a Mortgage Underwriter salaries in your area. Usually banks and building societies will offer between three and four-and-a-half times the annual income of you and anyone you are buying with. If you work backward a salary of 50000 a year amounts to 4166 per month.

The Mortgage Calculation for 90000. Learn about working at Major Mortgage from employee reviews and detailed data on culture salaries demographics management financials and more. This ensures you have enough money for other expenses.

100K salary and great credit buys a home above 700K. Lenders do not operate that way. 6533361 net salary is 9000000 gross salary.

Assuming principal and interest only the monthly payment on a 100000 loan with an APR of 3 would come out to 42160 on a 30-year term and 69058 on a 15-year oneMonthly payments for a 100000 mortgage. A 200k mortgage with a 45 interest rate over 30 years and a 10k down-payment will require an annual income of 54729 to qualify for the loan. Your salary will have a big impact on the amount you can borrow for a mortgage.

You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. If you make 120000 a year you can go up to 33600 a year or 2800 a monthas long as your other debts dont push you beyond the 36 percent mark. A mortgage of 90000 is to be repaid over a span of 25 years costing you 55268 every month.

Bills might come to 250month so if you can run the rest of your life car socialising travel holidays gifts stuff etc on 600month 20day then youd be fine. Monthly payment for. What is the payment on a 100k mortgage.

How did Research Maniacs calculate how much house you can afford if you make 90000. After taxes I take home. I would definitely like a nice house.

Salaries estimates are based on 2255 salaries submitted anonymously to Glassdoor by a. Lenders do not apply a multiplier to the borrowers annual salary to determine how much they can qualify to borrow. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Salary Range 48k - 77k 61k 61079. If you follow the 30 rule youd want your mortgage payment to be no more than 1250 per month. Medical or educational expenses.

Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 90000 to cover the total cost of debt payment s insurance and property tax. Read more about what lenders look at in the How Much. What mortgage can I afford on 120k salary.

If you want to buy a house with a 40000 salary and can meet lenders affordability criteria the following table will give you a guide as to how much you may be able to borrow on a mortgage. LTV loan to value is the percentage of your homes value which youre going to borrow as a mortgage. Annual Percentage Rate APR Monthly payment 15 year Monthly payment 30 year 500.

90000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Salary Range 53k - 76k 64k 64014. 361 rows Assuming you have a 20 down payment 18000 your total mortgage on a.

If youre saving a higher percentage than your local peers dont stop now. This means if youre buying alone and earn 30000 a year you could be offered anything. The driver for loan approval is the debt to income ratio DTI.

This mortgage example illustrates the monthly mortgage repayments on a 9000000 Mortgage with different repayment terms years to illustrate how changing the amount you pay each month can dramatically reduce the total amount of interest you pay on your mortgage as well as helping you to repay your mortgage over a shorter term and become mortgage free. For the high payment multiply the loan amount by 225.

Earnings Peak Graph Mobile Money Saving Advice Financial Tips Life Skills

Post a Comment

Post a Comment