C 0 Qa5 Ul Check appropriate box. Status and avoid section 1446 withholding on your share of partnership income.

W 9 Form What Is It And How Do You Fill It Out Smartasset

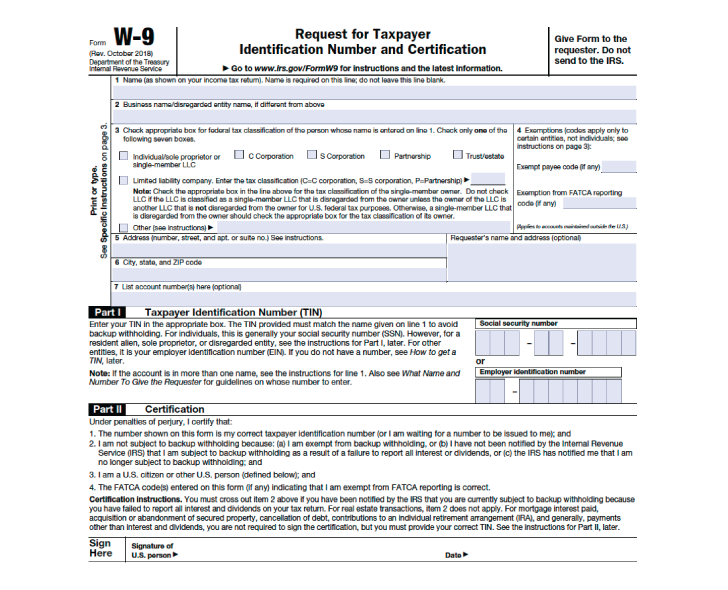

W9 Use Form W-9 to request the taxpayer identification number TIN of a US.

Mortgage w 9 form. Employers use the completed W-4 to determine how much to withhold from your paycheck for federal income taxes. Person including a resident alien to give your correct TIN to the person requesting it the requester and when applicable to. The W-9 form is required so that you can deduct your mortgage interest on your federal income tax return.

Form W-9 a statement that includes the information described above to support that exemption. 17461 that the foregoing is true and correct. Person including a resident alien to provide your correct TIN to the person requesting it the requester and when applicable to.

United States provide Form W-9 to the partnership to establish your US. You are requested to check the appropriate box for your status individualsole proprietor corporation etc. Use Form W-9 only if you are a US.

A return envelope listing US. Form W-9 is an IRS created form used by an individual or an entity like a company to request the taxpayer identification number TIN and other information from parties they have paid. Internal Revenue Service Name as shown on your income tax retum Ci RandDInstructionalSolutionsLLC Q Ol Ol Business name ifdifferent from above c.

In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. Its submitted by government in the best field. Certify that the TIN you are giving is correct or you are waiting for a number to be issued.

Form W-9 Request for Taxpayer Giveformtothe Rev. Status and avoid section 1446 withholding on your share of partnership income. A W-9 form is not required for all business transactions.

We resign yourself to this nice of How To Fill Out A W 9 Tax Form graphic could possibly be the most trending subject subsequent to we ration it in google help or facebook. In general W-9s are required only for business-to-business relationships where more than 600 is paid in the calendar year. What Is A W-9 and Why Does My Financial Institution Want Me to Sign One.

Person including a resident alien and to request certain certifications and claims for exemption. The notice provides a W-9 form requesting you to provide a correct and valid SSN or TIN to associate with your account. October 2007 Identification Number and Certification requesterDonot Department of the Treasury sendtotheIRS.

Businesses use this form to collect the tax ID numbers of individuals or other entities. In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. For example if you go into a store and spend money you dont need to get a W-9 from the store to ensure they are paying their taxes.

These include real estate transfer documents home loan documents and a federal W-9 form. The form must be completed and returned to the. Here are a number of highest rated How To Fill Out A W 9 Tax Form pictures upon internet.

Person that is a partner in a partnership conducting a trade or business in the United States provide Form W-9 to the partnership to establish your US. The certification instructions detailed on Form W-9 state that For mortgage interest paid acquisition or abandonment of secured property cancellation of debt contributions to an individual retirement arrangement IRA and generally payments other than interest and dividends you are not required to sign the certification but you must. Therefore if you are a US.

Banks Legal Research department is included with the mailing. United States provide Form W-9 to the partnership to establish your US. Status and avoiding withholding on its.

Use Form W-9 only if you are a US. A TIN number is typically an individuals social security number or a companys employer identification number. Entities that fail to provide a Form W-9 will be presumed to be a Non-Participating Foreign.

Status and avoid section 1446 withholding on your share of partnership income. Further in certain cases where a Form W-9 has not been received a partnership is required to presume that a partner is a foreign person and pay the withholding tax. I declare under penalty of perjury under the laws of the United States of America 28 USC.

Not return Form W-9 to the requester with a TIN you might to backup withholding. The W-9 form may be completed at any US. A W-9 form is completed by independent contractors and freelancers as a means of gathering information for the Internal Revenue Service.

If you are exempt from backup withholding you should still complete this form to avoid possible erroneous backup withholding. Once they have the form businesses dont send it to the IRS. Requester of Form W-9.

Citizens or resident alien clients must provide an IRS Form W-9 that as of July 1 2015 was revised by the IRS in December 2014. United States provide Form W-9 to the partnership to establish your US. A W-9 Request for Taxpayer Identification Number and Certification is a form created by the Internal Revenue Service IRS.

In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. 9-K merchant card and third party network transactions 8 home mortgage interest 1 student loan interest 9-C canceled debt 9-A acquisition or abandonment of secured property W-9 only if you are a US. Form W-9 is a really simple IRS form with precisely one function.

A Form W-9 is a document that is issued by the United States Department of the Treasurys Internal Revenue Service and is used when a person or company needs to request a Taxpayer Identification Number TIN claims for exemption and specific certifications from a person company trust or estate in the US. It lets you send your Tax Identification number TINwhich is your Employer Identification Number EIN or your Social Security number SSNto another person bank or other financial institution. Person including a resident ovide your correct TIN.

We identified it from obedient source. A W-9 form is a formal written request for information only and is used solely for the purpose of confirming a persons taxpayer identification number TIN. These forms also request information on tax exemptions.

A W-4 form requires some of the same information as a W-9 like your name address and Social Security number.

W 9 Form Arizona Mortgage House Team

Post a Comment

Post a Comment