As long as youve got a 10 deposit a clear credit history and no large debts or expenses you should have no problem getting a mortgage of up to x. We can currently get you.

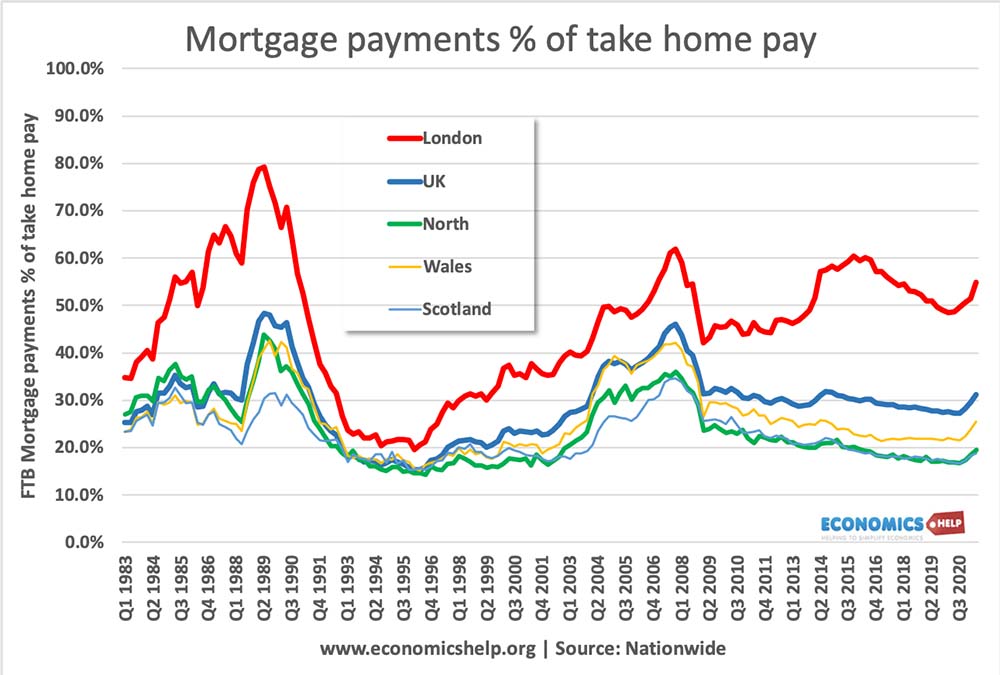

Uk House Price To Income Ratio And Affordability Economics Help

So-called supersized mortgages have hit the headlines following the launch of a new mortgage enabling professionals to borrow up to six times their salary.

Mortgage x salary uk. Youre unlikely to find a mortgage provider willing to lend to a maximum of x7 your salary or more in the UK. Depending on a few personal circumstances you could get a mortgage between x and x. As a single applicant on 35000 a year for example a mortgage of 245000 7 x salary would be unachievable alone.

However this amount is not representative of everyone and its important to know that even on a lower income you may still be able to get a mortgage. Yes its certainly possible to get a mortgage as a single applicant with this income multiple. I am happy to have a 30 year mortgage term.

I intend to be the sole applicant. This is generally not the case as we do work with lenders that will consider non professionals and those earning below 75000. Alternatively if you have a household income of more than 80000 you might find some banks will offer you a higher multiple.

I had assumed that banks would lend circa 4-5 times salary ie. For example if you have an income of 28000 a year and a lender provides you with a loan 45 times your salary you could potentially get a mortgage of 126000. Some other customers inform us that they have been told mortgages to 6 x salary are only available to professionals or high earners above 75000.

In joint applications only one borrower will be able to borrow 7 times their salary even if both are in an eligible profession or earn more than 75000. Mortgage lenders in the UK. But for everyone else from self-employed and contract workers to company directors barristers expats and seafarers you need to know which lenders will consider your circumstances and.

A 03 arrangement fee applies. For example some professional mortgages will let borrowers with specific jobs such as doctors dentists etc borrow five or five-and-a-half times their salary. When applying for the mortgage youll have to put put down a deposit of at least 15 and pay a fee of 999.

The mortgage offered by Darlington Building Society is available to those looking to borrow up to 90 of the property value. The Bank of England sets limits on how many mortgages lenders can grant at more than four and a half times the applicants annual salary but Habitos new deal falls outside of these rules. The rate offered is 269 discounted until April 2020 and the maximum loan limit is 450000.

The loans from online lender Habito are aimed at couples and allow them to borrow up to 15million. 1631 14 Dec 2018. As a rule of thumb banks will usually allow you to borrow around four or four-and-a-half times your annual income.

The most youll be able to borrow is 750000. For you this is x. According to the most recent Annual Survey of Hours and Earnings the average annual salary in the UK is 28677.

To qualify the highest income earner on the application must receive a gross salary of a minimum of 50000. 55x your salary if you earn 75K or 100K on a joint application if youve got a 15 deposit to borrow up to 2M. And for UK-based PAYE salary earners an increasingly rare breed documenting your earnings is fairly straightforward.

The other will be able to borrow up to 5. 5x your salary if you earn 45K and youve got just a 10 deposit to borrow up to 570K. However a 76 LTV mortgage will most likely have the.

Generally lend between 3 to 45 times an individuals annual income. To qualify youll also need a relatively high income at least 50000 if youre applying on your own or 75000 total if youre applying with someone else. That means that if you earn 30000 a year you could theoretically get a loan of 135000 or 270000 if youre buying with a partner who earns the same as you.

To qualify youll need to work. Simply because the majority of UK mortgage lenders cap their lending at 4-45 times income. 325k at max - but having completed HSBCs mortgage calculator they are suggesting that I could borrow 399k ie.

Assuming you want to get a new mortgage for the same amount 320000 with 100000 in equity you would have an LTV of just 76. However this product isnt available. Nine banks and building societies currently allow customers to borrow five times their income but the earnings requirements vary from 13000 a year to 100000.

Your balance at the end of the first 2 years is 1102 higher than if you kept your current loan. You can use the above calculator to estimate how much you can borrow based on your salary. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage.

Your remaining loan balance being 1102 higher is certainly worth the 153944 saved on monthly interest payments over the course of those 2. Thats because its One mortgage has a set interest rate for the entire term of the loan for example 25 or 30 years. With joint mortgages many providers allow you to borrow a multiple of the highest earners income plus the income of the second applicant.

Its able to offer mortgages up to an income multiple of 6 times. Over 6x salary with an LTV of 80-90. Return of the 7x salary mortgage 2021-12-28 - MORTGAGES for up to seven times a persons salary are on offer for the first time since the financial crisis.

They do this for two key reasons firstly the Bank of England sets restrictions to prevent mortgage providers from holding more than 15 of their mortgages at 45x or higher. Why are 5 x income mortgages more difficult to get. In a joint application only one person will be accepted for up to seven times salary while the other will have their salary multiplied by five.

This ought to be the easy part of a mortgage application. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right circumstances to work out how much mortgage you can afford.

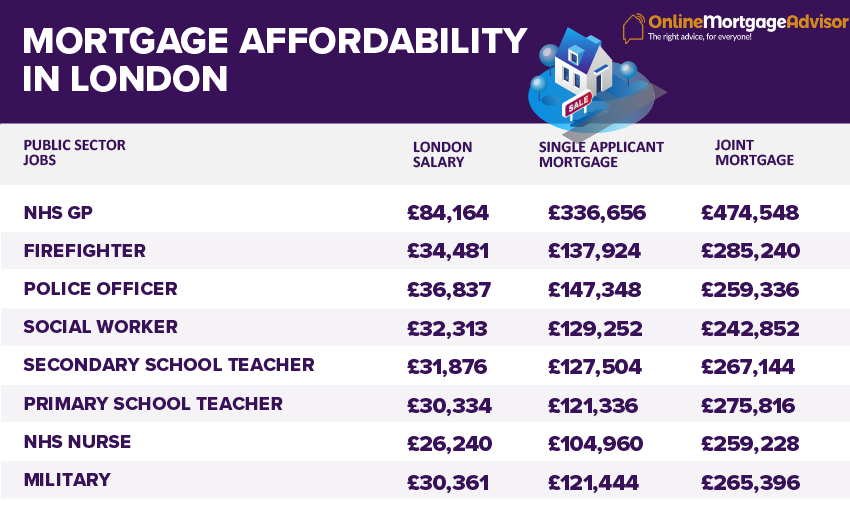

Mortgage Affordability Of Public Sector Jobs In The Uk

Post a Comment

Post a Comment