Deposit - 50000 20 of the value of the home Mortgage amount - 200000. To calculate a mortgages monthly repayment youll need to know the value of the home youre buying your deposit the interest rate and the length of term.

Mortgage Calculator Uk By Grimwood Android Apps Appagg

250 cashback On Completion or free legal fees.

Mortgage calculator uk. It has only been designed to give a useful general indication of costs. You can use both tools to help if youre house-hunting or looking to remortgage. A variable-rate mortgage can change month to month so you wont always pay the same amount.

Affordability calculator get a more accurate estimate of how much you could borrow from us. House value - 250000. Based on the figures which have been entered into our Mortgage Early Repayment Calculator.

Remember though the figures are only a guide to what you might pay - the exact cost will depend on the particular mortgage you choose. This is only a reference point. Mortgage rate 2.

Our mortgage calculators With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and. Your interest rates are variable we assume you have a fixed rate mortgage. More information on this mortgage.

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Our mortgage calculators can give you an idea of how much you could borrow and your monthly repayments as well as overpayments charges and more. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Your maximum property value is based on a Loan to Value LTV of 90 if a residential mortgage and 75 if a Buy to Let mortgage. This is an example of how your repayments would look over the course of your loan if the interest rate were to stay the same.

Check out the webs best free mortgage calculator to save money on your home loan today. Its important you always get a specific. Use the mortgage calculator to find out how much your monthly mortgage payments could be.

The mortgage market here is one of the most competitive in the world and they offer some of the most innovative mortgages found anywhere. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each. Free valuation admin fees England Wales Northern Ireland.

Find out how much you could borrow Our calculator gives you an idea of what you could borrow based on your income and outgoings. Our calculator includes amoritization tables bi-weekly savings. A fixed-rate mortgage means your interest rate will stay the same for the term of the deal.

Mortgage lenders in the UK. In addition explore various financial calculators as well as hundreds of other calculators addressing math health fitness and more. This should help you work out how much you could afford to borrow.

The guidance and or advice contained within this website is subject to the UK regulatory regime and is therefore primarily targeted to customers in the UK. We ask for a little more information as part of an Agreement in Principle application but it does. You can use our mortgage interest rate calculator to work out how much interest you might pay.

Generally lend between 3 to 45 times an individuals annual income. Telephone 0333 123 1972. The UK has a large variety of mortgages available for all kinds of people however the most popular appeal to everyone.

To get started all you need is the price of your property or the amount left on your mortgage. Mortgage term 30 years. You can use the above calculator to estimate how much you can borrow based on your salary.

Davids Park Ewloe CH5 3UZ. This advice applies to England. We calculate this based on a simple income multiple but in reality its much more complex.

If you are considering getting a mortgage in the UK we offer a wide range of mortgage calculators for residents of the United Kingdom to help them gather crucial information on a mortgage before or after they go to the bank. Free online mortgage calculator specifically customized for use in the UK including amortization tables and the respective graphs. Ad Start Calculating Mortgage Calculator Now - Try Its 100 Free.

It takes about five to ten minutes. Whether youre saving for your first home budgeting for your next or looking to save some money on your existing mortgage our calculators are here to help. Free valuation fees Max 1190England Wales Northern Ireland or 95 towards valuation feesScotland.

The estimated monthly cost assumes a 25 year overall mortgage term on a repayment basis and the average interest rate weve seen for the LTV above over the last three months 305. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. Ad Start Calculating Mortgage Calculator Now - Try Its 100 Free.

To use our mortgage calculators all you need to do is provide some information about your current income regular outgoings and where you are up to in your mortgage journey. Your estimated monthly repayments are with a total of due over the course of your mortgage repayments. Offset calculator see how much you could save.

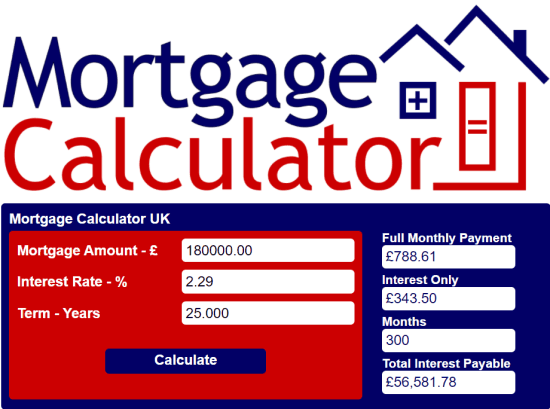

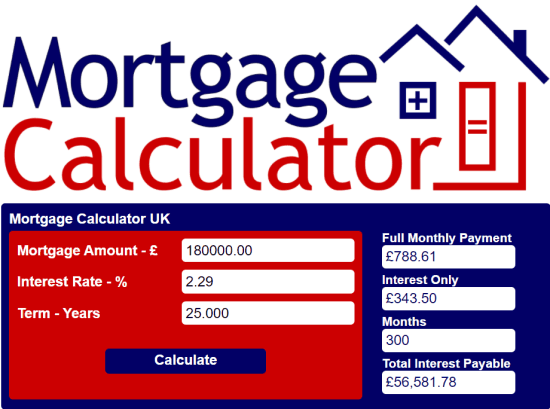

The total cost of a 180000 mortgage over 25 years is 258377. Our mortgage calculator and Agreement in Principle both give you an indication of how much you may be able to borrow towards the purchase of a property monthly repayments and potential interest rates. Shows the cost per month and the total cost over the life of the mortgage including fees interest.

Mortgage calculators help you understand how much you can borrow the stamp duty tax and what your mortgage repayments will be in the UK. Use a mortgage calculator if youre using Help to Buy. This will reduce the overall amount that you will be paying on.

Your mortgage if there was an interest rate rise. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. You can also adjust the mortgage term interest rate and deposit to get an idea of how those affect your monthly payments.

This information is computer-generated and relies on certain assumptions. If you continuously pay an amount of 80000 on a monthly basis then you will be able to repay your mortgage off in 21 months quicker than if you paid the regular monthly installment of 50000. Registered in England No.

5 Best Free Online Mortgage Calculators

Post a Comment

Post a Comment